Get Paid Now: Turn Invoices into Cash with Invoice Factoring

Get the cash you need to grow your business fast. Sell your open invoices with our quick and easy invoice factoring services.

Struggling with Cash Flow?

If so, you’re not alone. More than 60% of small businesses regularly struggle with cash flow issues. Reasons include: slow-paying clients, needing money to grow, or just needing a jumpstart to get started. Sound familiar? If so, don't worry, there are ways to manage your cash flow and keep your business healthy.

A loan or line of credit isn’t the only answer.

Denied for a bank loan or line of credit? Qualifying for a commercial loan or line of credit can be hard. Banks look at several factors. These include: collateral, business history, criminal background, profitability, revenue, and credit scores.

Do you need money fast? Traditional loan approvals take time due to document collection, credit reviews, and underwriting. Even after you’re approved, it can take a few days to receive funding.

Not wanting to take on more debt? Extra debt can reduce financial flexibility, hurt your credit score, and cause stress.

Invoice factoring can help.

Get approved with lesser requirements. Factoring approval is mostly based on your customers’ credit. Your credit scores, available collateral, length of time in business, profitability, and even some criminal offenses are not disqualifying from getting approved for factoring.

Get your money fast. You can get approved for factoring within hours and funded within as little as 24 hours after approval.

No additional debt. Invoice factoring is considered “off-balance sheet financing”. It is the sale of an asset (invoices) instead of a loan.

What is Invoice Factoring?

Invoice factoring is a financial transaction where a business sells its accounts receivables, or invoices, to a third-party factoring company at a discount. Your business receives immediate funds rather than waiting for customers to pay. We collect payment from your customers.

Our Invoice Factoring Services Include:

-

Same-Day Funding

-

Credit Analysis

-

Full-Service Billing

Same-Day Invoice Funding

We provide a cash advance on your unpaid invoices. You receive same-day business funding within hours.

You can submit your invoices and select your method of payment through our easy-to-use Funding Portal. We’ll fund up to 98% of the invoice amount the same day.

Credit Analysis

Our professional team analyzes credit and advises regarding funding eligibility.

Make streamlined decisions about what customers to serve, limit the risk of slow and non-payments, and save money on credit reporting subscription fees.

Full-Service Billing

Transwest Capital provides back-office support for Accounts Receivable management. We’ll invoice your clients and perform all collections duties on your behalf. You’ll maintain oversight through your online portal.

Save time on administrative work, focus on customer service and additional opportunities, and free your time to focus on growing your business.

What are the Benefits of Factoring?

Increase Cash Flow

Improved cash flow is the main benefit of invoice factoring. You sell your outstanding invoices to Transwest Capital at a discount, but gain access to a large portion of the invoice value upfront. This frees up money to cover expenses and grow your business.

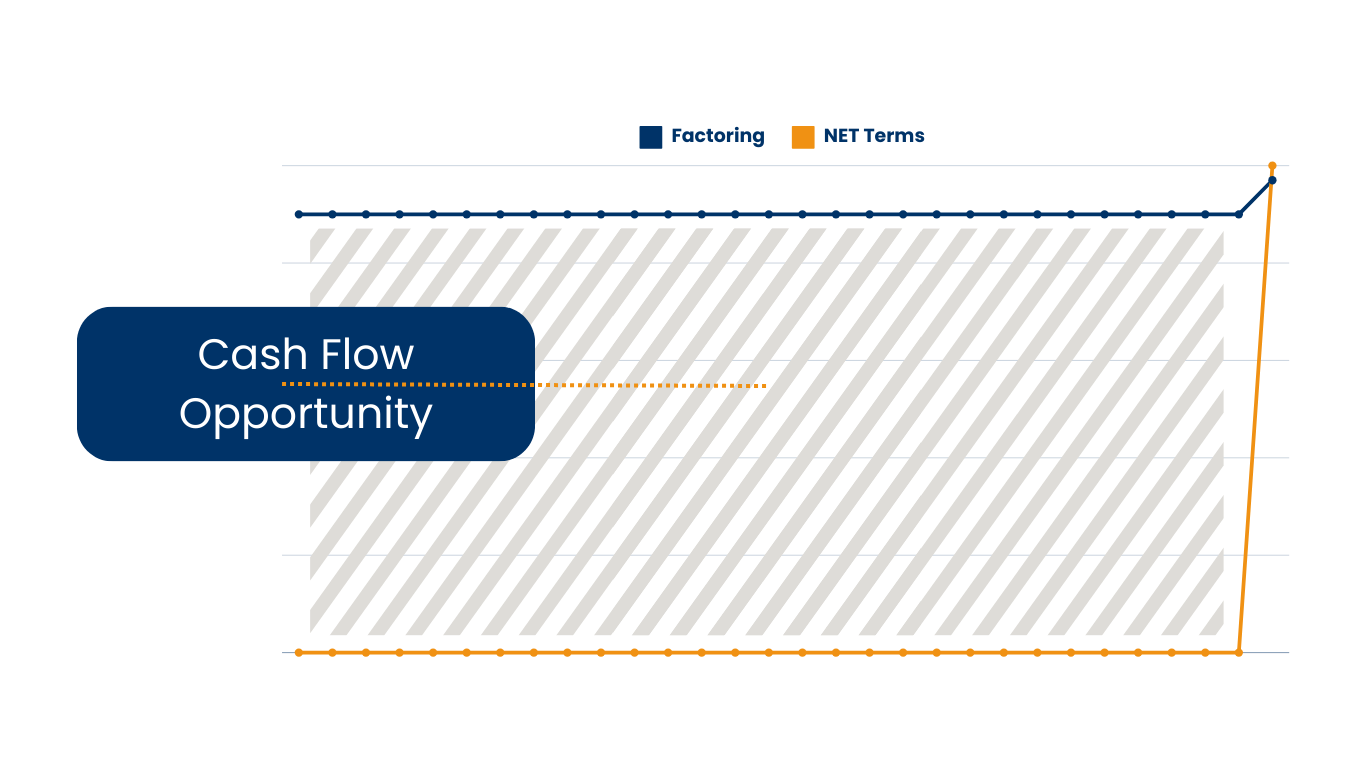

Example of cash flow in a factoring transaction vs. invoicing on NET30 terms.

Additional Benefits of Invoice Factoring

-

Faster Access to Working Capital

Streamline access to working capital by bypassing tradltional loan approvals. Unlike banks, we focus on your customers’ credit, allowing you to unlock cash quickly.

-

Reduced Risk of Bad Debt

Avoid bad debt by outsourcing your credit department. We provide credit analysis to protect your company from bad actors and clients with bad credit.

-

Simplified Accounts Receivable Process

Speed up collections by offloading invoicing and following up on late payments. This frees you up to focus on your core business.

-

Better Supplier Relationships

Avoid late payments to suppliers by getting paid early on your invoices. Keeping suppliers happy can lead to better deals in the future.

-

Improved Creditworthiness

Build good credit with more available cash to pay your bills on time. This positive track record makes it easier to get loans in the future.

-

Focus on Growth

By freeing up your cash flow and time spent managing Accounts Receivable, you can focus on strategic investments and growth initiatives.

How Invoice Factoring Works

Invoice factoring pays you upfront for your work minus a small fee. Here’s the breakdown:

You do business: You provide goods or services to your client.

Sell your invoice: Instead of waiting for payment, you sell the invoice to a factoring company at a discount (typically 1-5%). The factoring company invoices your client on your behalf.

Get cash advance: The factoring company advances you a majority of the invoice value (80-98%), usually the same business day.

They collect payment: The factoring company follows through with your customer to collect the full invoice amount.

Receive remaining balance (Reserve): Once your customer pays, the factoring company pays you the remaining balance after deducting their fee.

Invoice Factoring Example

The Challenge:

Meet Frank, owner of Frank’s Fasteners. Frank faces an exciting challenge. He has a reliable customer, Bob’s Builders, who consistently orders $100,000 worth of fasteners every month. However, Bob’s Builders has net 30-day payment terms, meaning Frank waits 1 month to receive payment for his supplies. This can strain cash flow, especially when a new opportunity arises.

The Opportunity:

Carl’s Construction, a much larger company, offers Frank his biggest order ever - $250,000 worth of fasteners. This is a golden opportunity for Frank’s Fasteners, but fulfilling this order requires upfront capital to purchase the necessary inventory. Frank doesn’t have the money sitting around, and waiting 30 days for payment from Bob’s Builders won’t work.

The Solution: Invoice Factoring with Transwest Capital

Remembering a recommendation from his friend, Frank consults with Transwest Capital. Here’s how factoring helps Frank seize the opportunity:

Selling the invoice: Frank decides to factor his invoices for Bob’s Builders. This means he sells his invoices to Transwest Capital at a discount.

Immediate Cash Injection: Transwest Capital pays Frank upfront - typically 80-90% of the invoice value. In this scenario, with an 85% advance rate, Frank receives:

$100,000 invoice x 85% advance rate = $85,000Transwest Collects from Bob’s Builders: Once Bob’s Builders pays the invoice in 30 days, Transwest Capital collects the full $100,000 from them.

Remaining Balance (Reserve): Transwest keeps a factoring fee (usually 1-5%) and remits the remaining balance to Frank. Here the factoring fee is 3% of the invoice amount:

$100,000 invoice x 3% fee = $3,000.

So, after the 30 days, Frank receives:

$100,000 invoice - $3,000 fee = $97,000.

Put another way, Frank received:

$85,000 advance (Day 1) + $12,000 reserve (Day 30) = $97,000 total.

In Conclusion:

Invoice factoring helped Frank turn a cash flow hurdle into a growth opportunity. By partnering with Transwest Capital, he secured a substantial new client and the capital needed to fulfill his largest order ever. This demonstrates how factoring can be a valuable tool for small companies to seize opportunities and significantly grow their business.

Who Can Use Invoice Factoring?

Your company can use invoice factoring if you meet the following criteria:

You sell to businesses (B2B) or government clients (B2G).

You invoice your clients and can provide proof of delivery.

You have clients with good credit.

Common industries we provide funding for include:

Factoring’s focus on your clients’ credit opens up funding opportunities for companies and business owners with challenging situations, such as:

Bad personal credit

Bad business credit

Tax issues

Unprofitable or minimally profitable businesses

Less-than-perfect background

Startups

Lack of collateral

Limited business history

Seasonal cash flow changes

Financing rapid growth

Why Clients Choose Transwest Capital

-

Same-Day Funding

Get paid within hours of sending your invoice

-

Competitive Rates

Fixed rates give you cost concertainty

-

High Advance Rates

Up to 90% of the invoice price is advanced the same day

-

Flexible Contracts

Choose from month-to-month or longer-term contracts

-

No Hidden Fees

No setup fees, monthly minimum fees, or invoice fees

-

Top-Rated Customer Service

Personal, available, reliable service - 4.9 rating on Google Reviews

We Go Above and Beyond

“If you’re looking for a good factoring company, I highly recommend Transwest Capital. We’ve been working with Transwest Capital for almost 10 years and I can say we are very pleased to be working with them. They show great customer service, they work above and beyond to help with anything, they show appreciation to their customers, and they never fail to impress me. Thank you guys! We appreciate your business!”

— Humberto R.

“I think I’ve gotten lucky and found my first and last factoring company. It’s only been a couple weeks so far, but Transwest Capital has shown me that they are proud of their clients and will go above and beyond to make sure they are taken care of, no matter the size of the company. The people I have spoken with so far has been easy to talk to and have shown a great deal of integrity.”

— Eric A.

“What an incredible factoring company! [They go] above and beyond to ensure you receive the best possible service and answers. Definitely committed to excellence.”

— William H.

Our People Make a Difference

“I have been working with Transwest for over a year now. Everyone there is super nice, professional and informative. Best factoring company with the best people.”

— Haley M.

“Great people! Very comforting and professional. We love this partnership!!!!!”

— Diamond M.

“Staff is very friendly and doesn’t ever seem bothered even if I’ve called 5 times in one day, my concerns/questions were always handled with kindness and accurate information. 10/10 recommend working this this company rather than those big guys.”

— Jeremiah M.

We Make Factoring an Amazing Experience

“I WAS STRUGGLING BAD AT MY PREVIOUS FACTORING COMPANY. I got a referral from a friend that told me all about their experience with Transwest Capital so I call them. It was an amazing experience right from the first phone call…Now that I am here and the experience as promised is the best. Would definitely recommend to anyone and everyone.”

— Robert H.

“Awesome experience and service. Highly recommend this factoring company for anyone who wants things done efficiently and on time with professionalism.”

— LaDarius P.

“My experience has been A+ from getting set up to factoring my first load. The staff is top shelf very helpful. I would highly recommend Transwest Capital for your factoring needs.”

— Chris

Invoice Factoring FAQs

-

The 2 types of invoice factoring are recourse factoring and non-recourse factoring:

Recourse factoring means that you are responsible for paying the factoring company if your client does not pay due to insolvency or bankruptcy.

Non-recourse factoring generally refers to an arrangement where you are not responsible for paying the factoring company if your client does not pay due to insolvency or bankruptcy.

-

A typical factoring fee is between 1% and 5%. The rate is determined by many factors, such as invoice volume, average invoice amount, factoring type (recourse vs. non-recourse), your clients’ credit, and how long it takes your client to pay the invoice. Get your custom quote today.

-

Factoring fees can typically be written off as an ordinary and necessary business expense, as defined by the IRS. However, as with any tax-related question, you should work with a trusted tax professional to determine deduction eligibility and properly account for these expenses.

-

No, you do not have to factor all of your invoices. You may choose which customers (Accounts Receivable) to factor. When you sell an for a specific customer, we will send them a “Notice of Assignment”, which notifies them of our factoring relationship and instructs them to set us up as the Payee in their Accounts Payable system. Once this is done, you will need to factor all of your invoices for that customer at least until we are fully repaid by that specific customer. You cannot bounce back and forth between factoring some invoices and then billing directly for a given customer.

Example: Your company has 4 clients - Companies A, B, C, and D. You have a short-term cash flow issue, so you want to factor some invoices but not all of your invoices. You decide to factor Company A invoices while you continue to invoice Companies B, C, and D. This gives you some instant cash flow but also saves you on expenses if you were to factor all of your invoices.

-

Invoices can be factored within hours. However, it’s important to note that certain issues can cause funding delays. Such issues include but are not limited missing/illegible paperwork and invoice verification delays.

Our team is proactive in communicating such issues with you and your customers to avoid delays and get you funded as quickly as possible.

-

Invoice factoring is not considered a loan. It is the sale of one asset (invoice) for another asset (cash). This is considered “off-balance sheet financing” and no debt is incurred.

-

Your customers pay the factoring company. When you sell an invoice, a “Notice of Assignment” is sent to your customer. This document notifies your customer of the factoring relationship and instructs your customer to set up the factoring company as the Payee in their Accounts Payable system. Your fees are just deducted from the amounts advanced to you by the factoring company.

-

Invoice factoring setup can be completed in as little as 1 day. You can get approved within hours and funded within 24 hours after approval and finalizing your factoring agreement.

However, it’s important to note that some issues can cause delays with invoice factoring setup, such as missing/illegible paperwork, delays in account setup with your client(s), and invoice verification delays.

Our promise is to work as quickly an dligently as possble with you and your customers so that we can get you funded fast. Ready to set up invoice factoring? Get your custom quote now.

-

Documentation needed for factoring is simple.

To apply: Application, Articles of Incorporation/Articles of Organization, copy of a Driver’s License for each company officer, client list, and current AR Aging Report.

To finalize account setup: Voided check, copy of utility bill in your name with your current billing address, copy of IRS SS4 form showing Federal Tax ID#, and a copy of IRS W-9 form.

To factor an invoice: Terms may vary by industry, but you’ll just need your invoice and proof of delivery.

-

We do not run your credit. Your personal and business credit scores do not factor into our approval, because we will be repaid by your clients.

-

Factoring companies will typically run a background check. While less-than-perfect backgrounds can be approved for factoring, certain violent or financial crimes may be disqualifying.

-

The main difference between invoice factoring and invoice financing is that invoice financing is a loan. It uses your invoices as collateral. Invoice factoring is not a loan. It involves the sale of your invoices.

Additional differences include:

Who collects from the client: With factoring, the factoring company collects. With invoice financing, you collect.

Customer awareness: With factoring, your customer is aware of the factoring relationship. They pay the factoring company direct. With invoice financing, they are unaware of the lending relationship. You collect from them as usual.

Control over collection: With factoring, you have less control over collection. The factoring company collects for you. With invoice financing, you retain control over collection.

Learn More About Invoice Factoring